VAT/GST Alerts

Category: VAT

VAT: 2020 QUICK FIXES – CHAIN TRANSACTIONS

The EU “quick fixes” package relating to cross-border trade will come into effect from 1 January 2020. Here we provide an overview of the chain transaction quick fix and highlight what businesses need to be doing to prepare for the new rules.

10 October 2019| CATEGORIES: 2020 Quick Fixes, VAT

VAT: 2020 QUICK FIXES – CALL-OFF STOCK

The EU “quick fixes” package relating to cross-border trade will come into effect from 1 January 2020. Here we provide an overview of the call-off stock quick fix and highlight what businesses need to be doing to prepare for the new rules.

7 October 2019| CATEGORIES: 2020 Quick Fixes, VAT

VAT: 2020 QUICK FIXES – CUSTOMER VAT IDENTIFICATION NUMBER

The EU “quick fixes” package relating to cross-border trade will come into effect from 1 January 2020. Here we provide an overview of the quick fix relating to the requirement to obtain a customer’s VAT identification number.

7 October 2019| CATEGORIES: 2020 Quick Fixes, VAT

VAT: 2020 QUICK FIXES – PROOF OF TRANSPORT

The EU “quick fixes” package relating to cross-border trade will come into effect from 1 January 2020. Here we provide an overview of the proof of transport quick fix and highlight how businesses can prepare for the new rules.

7 October 2019| CATEGORIES: 2020 Quick Fixes, VAT

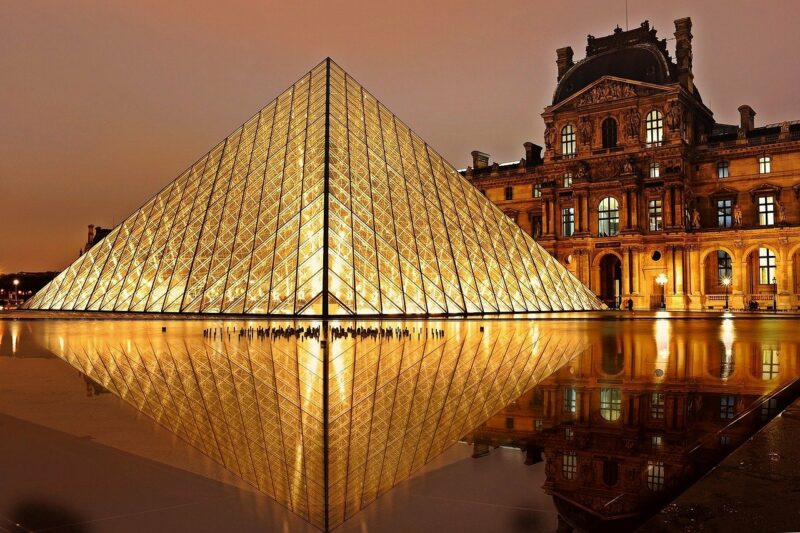

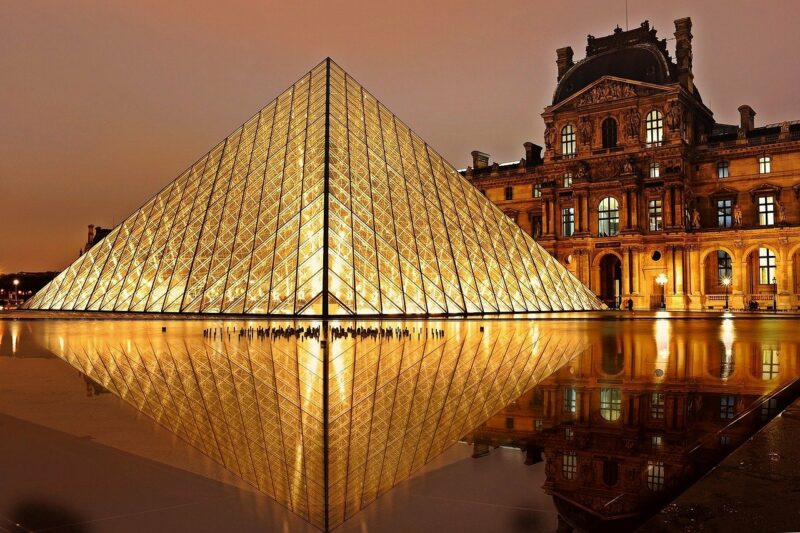

France: New invoicing requirements from October 2019

In April 2019, the French government adopted Ordinance N° 2019-359, amending the French Code of Commerce. The Ordinance included amendments to the information that is mandatory on an invoice for businesses that are VAT registered in France.

1 October 2019| CATEGORIES: VAT

Australia: Goods and Services Tax (GST) on B2C Low Value Imported Goods

From 1 July 2018, Australia imposed a 10% Goods and Services Tax (GST) on the sale of low value goods costing AUD 1,000 or less supplied by overseas retailers to Australian consumers. Our VAT alert looks at the actions impacted businesses should take.

16 July 2018| CATEGORIES: Low value imported goods, VAT